NSE freak trade fiasco: Will it go scot-free again?

Given the opaque style of functioning and NSE being the favoured exchange of SEBI, the exchange will go scot-free once again. However, SEBI should seek clarification from NSE and also penalise both exchanges for not following its circular on index-wide filters

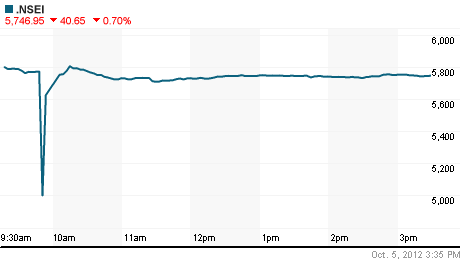

The so-called high-tech systems of National Stock Exchange (NSE) failed today. The exchange which boasts as technologically advanced was hit by a trading error. What I wonder most was not the error but the index which had to stop trading as 10% circuit filter went all the down to 4,888 which is 15.8% down (As per NSE’s own website the day’s low is 4888.2).

If one reads the NSE's circular dated 28th September (http://www.nseindia.com/content/circulars/CMTR21799.pdf ), a 570 point (10%) should have triggered the circuit breaker. Once the circuit breaker is hit, the market (both NSE & BSE) have to be closed immediately for one hour.

Extract from the circular is as follows:

On September 28, 2012, the last trading day of the quarter, Nifty closed at 5,703.30 points. The absolute points of Nifty variation (over the previous day’s closing Nifty) which would trigger market-wide circuit breaker for any day in the quarter between 01 October 2012 and 31 December 2012 would be as under:

As regards, to circuit filter, this is what NSE website says: (http://www.nseindia.com/products/content/equities/equities/circuit_breakers.htm)

Index-based market-wide circuit breakers

The index-based market-wide circuit breaker system applies at three stages of the index movement, either way viz. at 10%, 15% and 20%.These circuit breakers when triggered, bring about a co-ordinated trading halt in all equity and equity derivative markets nationwide. The market-wide circuit breakers are triggered by movement of either the BSE Sensex or the NSE S&P CNX Nifty, whichever is breached earlier.

• In case of a 10% movement of either of these indices, there would be a one hour market halt if the movement takes place before 1:00pm. In case the movement takes place at or after 1:00pm but before 2:30pm there would be trading halt for half an hour. In case movement takes place at or after 2:30pm there will be no trading halt at the 10% level and market shall continue trading.

• In case of a 15% movement of either index, there shall be a two hour halt if the movement takes place before 1.00 pm. If the 15% trigger is reached on or after 1:00pm but before 2:00pm, there shall be a one hour halt. If the 15% trigger is reached on or after 2:00pm the trading shall halt for the remainder of the day.

• In case of a 20% movement of the index, trading shall be halted for the remainder of the day.

These percentages are translated into absolute points of index variations on a quarterly basis. At the end of each quarter, these absolute points of index variations are revised for the applicability for the next quarter. The absolute points are calculated based on closing level of index on the last day of the trading in a quarter and rounded off to the nearest 10 points in case of S&P CNX Nifty.

So as per today’s incident, NSE should have stopped trading as soon as it hit the 10% down circuit. How was this possible as the index went all the way down to 4,888, which is around 900 points down from previous close and more than 15%. The circular by the Securities and Exchange Board of India (SEBI) further says that all exchanges shall stop trading once the limit is hit.

So,

1. How was it possible that market hit 15% downward limit and not stop at 10% while it was trading normally?

2. Why did BSE not stop trading as soon as the NSE circuit was hit as per SEBI circular?

3. How did NSE restart trading within minutes utterly disregarding the SEBI circular which says the market should be halted?

4. Do NSE and BSE have the powers to supersede the SEBI circular?

It is high time that NSE comes out with answers. I am sure that given the opaque style of functioning and NSE being the favoured exchange of SEBI, it will go scot-free once again.

I hope investors will get answers and I wish SEBI will gather the courage to stand up and seek clarification from NSE and also penalise both exchanges for not following its circular on index-wide filters.

-----------------------------------------------------------------

CREDIT : Mr.Gopinath Prabhu for http://www.moneylife.in/