THE WISDOM OF THE GURUS

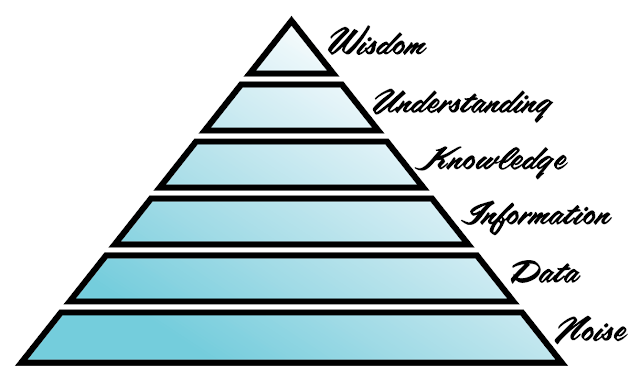

The above picture is worth a thousand words so this one should be priceless since it has some amazing insight and wisdom.

Now, appraise yourself "Where you are ?"

*****

Why most people not able to make big money in the stock market? Your quest for the Holy Grail ends here. The answer had always been there, only it had to be put in the right context. It is there in the words of the gurus of stock investing. Here is a short compilation of the wisdom of the gurus which will reveal to you the secret of winning in the stock market.

1.

Failing to

appreciate what common stocks are

Although it's easy to forget

sometimes, a share is not a lottery ticket... it's part-ownership of a

business.

- Peter Lynch

- Peter Lynch

Behind every stock is a company. Find

out what it's doing.

- Peter Lynch

- Peter Lynch

2.

Not studying the

business before investing in the stock

Know what you own, and know why you

own it.

- Peter Lynch

- Peter Lynch

If you don't study any companies, you

have the same success buying stocks as you do in a poker game if you bet

without looking at your cards.

- Peter Lynch

- Peter Lynch

3.

Failing to invest

or stay invested in a good stock during times of crisis

Unless you can watch your stock

holding decline by 50 per cent without becoming panic-stricken, you should not

be in the stock market.

- Warren Buffett

- Warren Buffett

Cash combined with courage in a time

of crisis is priceless.

- Warren Buffett

- Warren Buffett

4.

Not thinking long

term and not being disciplined and patient

If you are not willing to own a stock

for 10 years, do not even think about owning it for 10 minutes.

- Warren Buffett

- Warren Buffett

Successful Investing takes time,

discipline and patience. No matter how great the talent or effort, some things

just take time: You can't produce a baby in one month by getting nine women

pregnant.

- Warren Buffett

- Warren Buffett

5.

Indulging in

derivatives and stock trading

Deivatives are financial weapons of

mass destruction.

- Warren Buffett

- Warren Buffett

As in roulette, same is true of the

stock trader, who will find that the expense of trading weights the dice

heavily against him.

- Benjamin Graham

- Benjamin Graham

6.

Paying too much for

the stock

If you are shopping for common

stocks, choose them the way you would buy groceries, not the way you would buy

perfume.

- Benjamin Graham

- Benjamin Graham

Confronted with a challenge to

distill the secret of sound investment into three words, we venture the motto,

Margin of Safety.

- Benjamin Graham

- Benjamin Graham

7.

Blindly following

the crowd

We simply attempt to be fearful when

others are greedy and to be greedy only when others are fearful.

- Warren Buffett

- Warren Buffett

Wall Street is the only place that

people ride to in a Rolls Royce to get advice from those who take the subway.

- Warren Buffett

- Warren Buffett

8.

Making exceptions

to sound investing principles as per the latest fad

The individual investor should act

consistently as an investor and not as a speculator.

- Benjamin Graham

- Benjamin Graham

With every new wave of optimism or

pessimism, we are ready to abandon history and time-tested principles; but we

cling tenaciously and unquestioningly to our prejudices.

- Benjamin Graham

- Benjamin Graham

9.

Underestimating

your potential as an investor

Twenty years in this business

convince me that any normal person using the customary three percent of the

brain can pick stocks just as well, if not better, than the average Wall Street

expert.

- Peter Lynch

- Peter Lynch

If you have more than 120 or 130 I.Q.

points, you can afford to give the rest away. You don't need extraordinary

intelligence to succeed as an investor.

- Warren Buffett

- Warren Buffett

10. Last but not the least: Making costly mistakes

It is remarkable how much long-term

advantage people like us have gotten by trying to be consistently not stupid,

instead of trying to be very intelligent.

- Charlie Munger

- Charlie Munger

Rule #1: Never lose money; Rule #2:

Never forget Rule #1.

- Warren Buffett

- Warren Buffett

----------------------------------------------------------